Auckland Council’s Governing Body agreed several policy decisions last week which will direct how voluntary Category 3 property buyout offers will work.

Decisions about the policy were guided by Auckland Council’s want to support Aucklanders to voluntarily relocate from homes that pose an intolerable risk to their lives.

We have sought to balance the financial commitments to ensure the policy is affordable for Auckland, while being fair and equitable for all affected homeowners.

You can read the media release from Mayor Brown.

Governing Body will make further decisions about categorisation, including what is deemed to be affordable and feasible for mitigations for Category 2 properties. They will also agree the funding allocation for Category 2 mitigation projects and determine if any funding will be available for property owners requiring mitigation work on their private property (Category 2P properties).

Here’s a summary of the decisions made on Friday 6 October:

A pre-weather event market valuation will be used to determine the starting point for the voluntary buyout offer. The date that will be used for the valuation will be communicated shortly. The process for undertaking the valuation is now being finalised, following the Governing Body decisions on Friday.

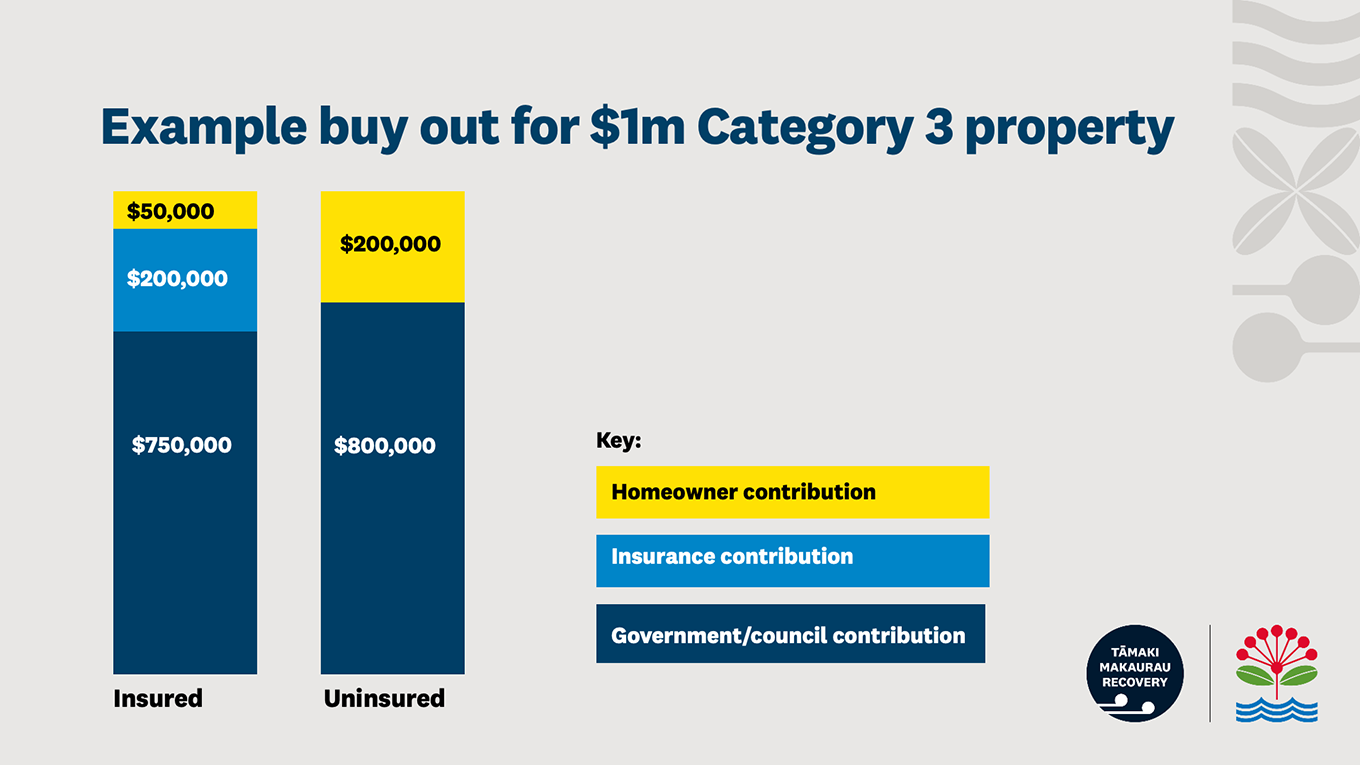

We will offer 95% of the value of an insured property, less any insurance payout (including EQC). This means that the property owner is making a 5% contribution towards the cost of the buyout.

For properties that are not insured, we will offer at least 80%, up to 95% of the value of the property. This means that the property owner is making up to a 20% contribution towards the cost of the payout. Council may offer you more than 80% based on individual circumstances relating to insurance status. There will be more information about when council will take "individual circumstances" into account in the Scheme Terms and this will be discussed with you.

At the time that offers are made, it will be communicated to homeowners how long the offer is valid for. The timeline will recognise that you will want to take time to thoroughly consider the offer and seek your own legal advice about it. Auckland Council will make a contribution towards professional services (like legal fees). The amount of this contribution, what this can be used for, and when it will be available, will be explained to you.

Secondary properties, meaning the property owner doesn’t live at the affected address (eg holiday homes and residential rental properties), can be eligible for a buyout. This recognises that many secondary homes have tenants living in them. Because the intent of the policy is to remove people from places where there is risk to life during extreme weather, any Category 3 homes where people can live are in scope for a buyout.

The Governing Body agreed in principle to a dispute process that has both an internal review and an external independent review component. A dispute process will be available for property owners who disagree with their categorisation and/or disagree with their property valuation. The process is being finalised, and information about this will be available at the initial homeowner conversation.

What happens next?

Across the region, risk assessments (both flood affected, and landslide affected homes) are underway where properties have opted-in to be part of the categorisation process.

As we have signalled already, buyout conversations with property owners will begin in late October, as properties are confirmed as Category 3.

Alongside the risk assessment programme, staff are preparing technical advice to inform the remaining policy decisions required from Governing Body in late October.

How will the buyout process work?

The exact details of the buyout process are still being finalised and will be communicated directly to Category 3 property owners at the start of the buyout process. While insurance and finances are controlled by homeowners, we are coordinating with the insurance and banking sector to try to make this process as easy for you as possible.

We know you have a lot of questions about the detail of the process including how valuations will be gathered and what input you have into these, how long everything will take, and your options if you disagree with decisions. Please be assured that our team is working as quickly as possible to finalise these details so they can be shared.

The process of selling your home under these circumstances will be a very challenging experience for customers to go through, and we are focussed on ensuring information is easy to understand, and that you have support available at every step along the way.

As part of the initial conversation we have with you, you will be introduced to the individuals that will support you along the way – both for the property transaction and for additional wrap-around support you may need.

If access to your home is prohibited or restricted because it is too dangerous to enter, we will work with you on managed access so you can safely move your belongings out where possible.

Over the coming weeks, we will be providing more information to affected property owners, and we appreciate your patience as we finalise these details for you.