Recent city centre data for footfall, retail spend and office vacancy rates in the latest Insights Paper from Auckland Council’s Chief Economist Gary Blick shows the recession is still being felt, but a new map of the 5-minute walkable area surrounding the City Rail Link’s Te Waihorotiu Station points to a more promising outlook.

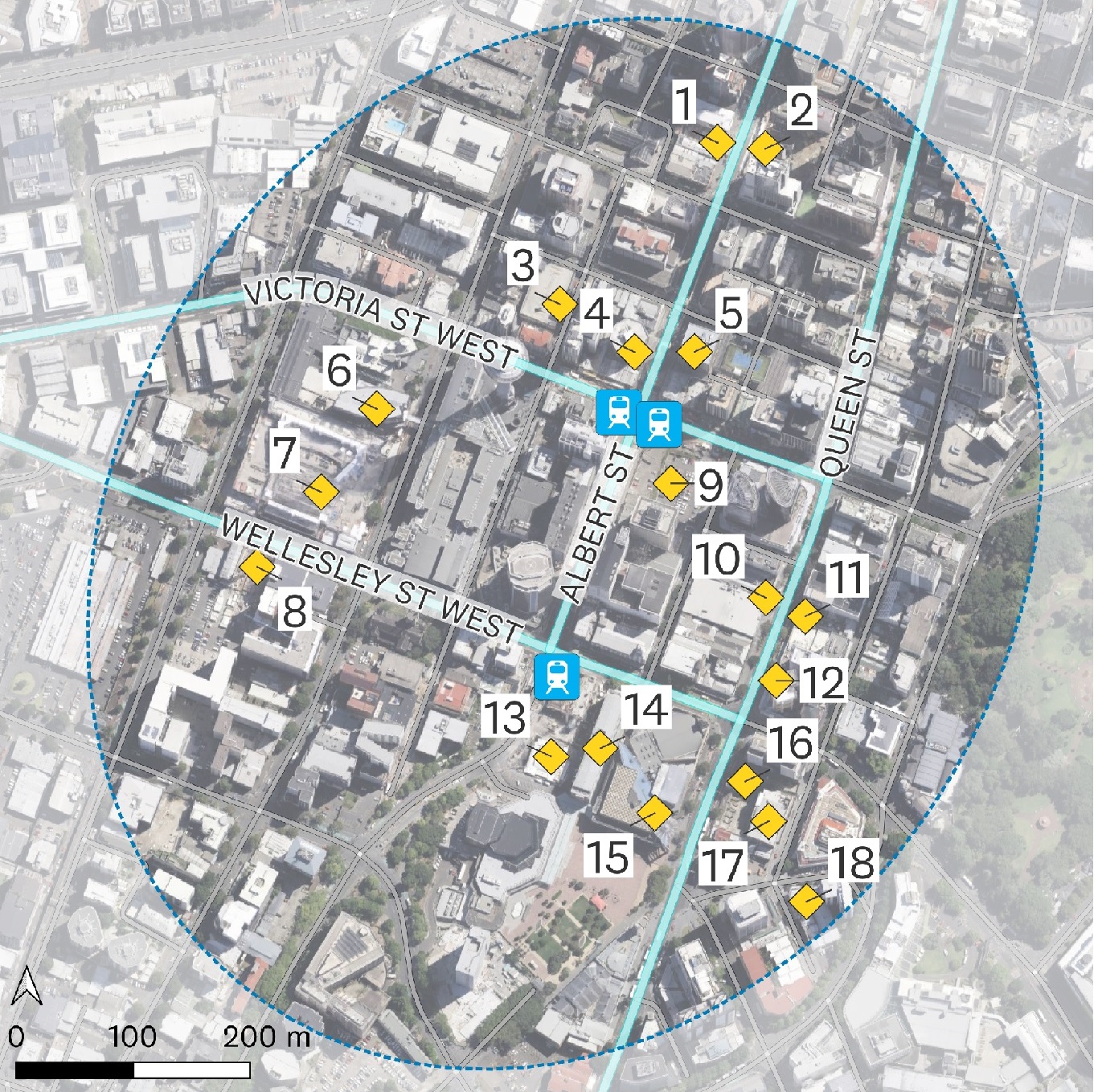

The new map pinpoints 18 private developments which are planned, under construction, or recently completed, within a 0.57km2 area around the station.

The Chief Economist’s paper notes a drop in foot traffic and retail spend in the city centre compared with last year, mostly off the back of a nationwide recession driven by high interest rates.

However, the report also notes that the private sector continues to have confidence in the economic prospects of the city centre.

“These 18 developments with a mix of commercial, retail and residential uses, represent billions of dollars of investment. They illustrate the confidence the private sector has in the benefits the City Rail Link will bring; a promising sign for the city centre’s future,” says Gary Blick.

Read the full December 2024 Insights Paper from Auckland Council’s Chief Economist Gary Blick.

Jenny Larking, Head of City Centre Programmes at Auckland Council, comments on the findings from the report.

“There’s no doubt this has been a tough year for our city centre and the businesses based here, and the data reflects that. However, it also gives me great optimism for our city centre’s future, particularly in midtown,” Larking says.

“Not only will midtown be dotted with shiny new private developments and a new train station, but also with expansive streets giving more room for people - with trees and landscaped lunch spots, cycle lanes and better connections to buses.

“Both private and public investment will see our city centre thrive well into the future,” she says.

The report cites three supportive tailwinds for this confidence in the city centre’s future:

- Growth – Auckland’s population is projected to continue to grow, driving demand for services and housing that should benefit the city centre.

- Services – the trend towards a more knowledge-intensive, service-based economy should support demand for commercial office space.

- Access – the City Rail Link will bring new stations, more frequent services, and reduced travel times, lowering the cost of reaching the city centre.

The report notes that ‘the city centre’s offering is weighted to hospitality and accommodation, which are more discretionary expenses than everyday essentials, like groceries and fuel. This means the city centre is more sensitive to changes in household spending than Auckland overall.’

Looking ahead, the paper concludes that ‘the combination of investment, improved access, and a growing population points to a more promising outlook for Auckland’s city centre’.

The pattern of private sector investment shown in the map of midtown echoes private sector investment reported across the city centre, and especially around other station neighbourhoods, where a total estimated $6b in private investment has followed public investment in urban realm improvements.

MAP KEY - the map shows walking distance of approximately five minutes: (1) 51 Albert (hotel & residential); (2) 50 Albert (commercial office); (3) 65 Federal St; (4) Formery; (5) DoubleTree by Hilton; (6) Horizon Hotel; (7) International Convention Centre; (8) Hotel Grand Chancellor; (9) NDG Auckland Centre; (10) Strand Arcade redevelopment; (11) 256 Queen St (student accommodation); (12) 280 Queen St (Radisson Red hotel); (13) The Symphony Centre (residential & commercial); (14) Bledisloe House redevelopment; (15) OnQ Entertainment Centre redevelopment; (16) St James Suites (residential); (17) St James Theatre restoration; (18) 64 Lorne St (student accommodation). Source: public announcements