Mayor Wayne Brown is proposing to consult Aucklanders on a new regional wealth fund that would provide a better return on investment from Auckland Council’s assets. The Auckland Future Fund would make provision for climate change risks through self-insurance and help mitigate rates rises for Aucklanders.

Auckland Future Fund

-

A better return on investment

-

Increased non-rates revenue

-

Reduced risk by diversifying markets and geographic locations

-

Provision for self-insurance against climate change risks

-

Protection of intergenerational assets and their value.

The Auckland region faces long-term risks due to climate change, as demonstrated by the Auckland floods and Cyclone Gabrielle, including damage to Auckland Council’s physical assets, restricted access to capital and insurance, and the cost of moving to a net-zero economy.

“Any natural disaster or pandemic would impact Auckland’s airport and ports, as well as the Council’s other strategic assets. It just makes sense to spread our exposure to risk across different markets and geographic locations. The last thing you want is to have all your eggs in one basket,” says Mayor Brown.

The Auckland Future Fund’s initial capitalisation of $3-4 billion would come from the proposed contribution of the Auckland International Airport (AIA) shares and the proceeds of a port operating lease.

“Our biggest assets have not performed as well as we could expect from a well-managed diversified fund. While Ports of Auckland is turning around, it still doesn’t cover the average cost of capital. The dividend from Auckland International Airport doesn’t cover the cost of capital either. This means the council has lost money and ratepayers are subsidising our ownership of both the port and airport,” says Mayor Brown.

“Auckland Council has relied on borrowing money to bridge the gap between revenue and expenditure. And, a big part of why revenue is always behind expenditure is because we have large-scale investments that have not generated returns to cover the cost of owning them.

“Auckland’s strategic assets have been built up over generations. I don’t believe in using these assets for short-term gain, but I do believe in making better use of what we have.”

At least $1 billion from the proposed Auckland Future Fund would be earmarked for self-insurance, saving Auckland Council almost $25 million in annual insurance premiums. During the current financial year, Auckland Council’s property insurance costs have risen more than 44 percent.

“The cost of insuring council property is rising, particularly against climate-related risks, and self-insurance would be a smart way to manage those risks and our money. There are also critical assets that the council group can’t get insurance for, such as roads and pipes, and we need to make some provisions to repair or replace those too,” says Mayor Brown.

Once fully capitalised, the proposed $3-4 billion Auckland Future Fund would be mandated to achieve a return of at least 7.5 percent, of which Auckland Council would receive a minimum cash return of $180 million, or around 6 percent. This would generate greater non-rates revenue that would help offset rates increases.

Any surplus would be reinvested in the fund to preserve and grow its capital and protect the value of Auckland Council’s intergenerational assets, so they continue to benefit future generations.

The proposed Auckland Future Fund would be designated a strategic asset under Auckland Council’s Significance and Engagement Policy, protecting it from divestment for short-term gain, but leaving fund managers free to trade.

Making the most of Auckland's Waterfront

Mayoral proposal recommendations:

-

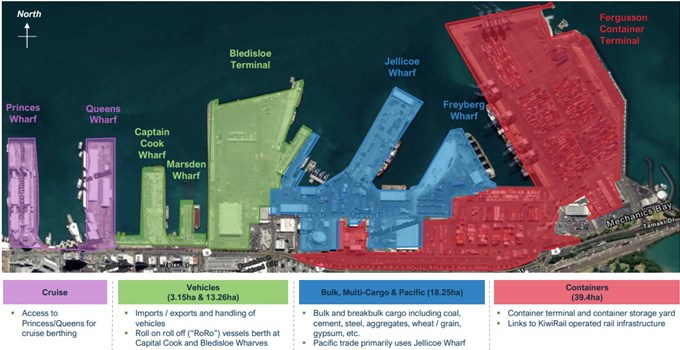

Return Captain Cook Wharf and Marsden Wharf to Auckland Council within two years, followed by Bledisloe Wharf within 15 years.

-

Consult on two options – enhancing the status quo, or leasing the Port’s commercial operations.

-

Port is not for sale: retain all Port land and strategic assets in public ownership

-

Improve Port efficiency and development

-

Provide certainty to businesses and workers about the future, by keeping the port in Auckland for at least 35 years.

The Mayor remains committed to his vision of delivering Aucklanders the most beautiful and loved publicly owned waterfront of any harbour city in the world.

“The majority of Aucklanders want prime waterfront land released back to the public, so they can make the most of the Waitematā Harbour at the heart of our city centre. Ports of Auckland has agreed that Captain Cook Wharf and Marsden Wharf can be released within the next two years. And the release of this land will have no material impact on the port’s commercial value, with all trade retained,” says Mayor Brown.

“While I am pleased that Ports of Auckland has a turnaround strategy and is delivering healthier dividends, it would be a missed opportunity if we didn’t look at other ways to get a better return on this valuable asset. We have narrowed it down to two options – enhancing the status quo, or leasing the port’s commercial operations – and aim to consult the public on both.”

A benefit of the lease model is that any port operator or investor would be expected to pay for the right to partner with Auckland Council, somewhere in the region of $2-3 billion, which would be reinvested in the Auckland Future Fund.

“A couple of billion up-front, while ensuring the port’s future, growth, and jobs – compared to Port dividends of only $355 million over the past decade – seems like something we should explore,” says Mayor Brown.

Ownership and protections

Auckland Council currently bears all of POAL’s financial and operating risks but has very limited direct influence on port operations.

Contrary to common perceptions of public ownership in this space, the Port Companies Act prevents Auckland Council from interfering in port operations and makes clear that the principal objective of the Port must be to operate as a successful business. This means the Council cannot direct POAL to subsidise trade for the benefit of the Auckland economy or ask the Port to implement any particular employment relations.

“While Ports of Auckland is 100 percent owned by Auckland Council, the idea that we have any day-to-day operational control is nonsense. Our only real power is to appoint directors, who must then act independently,” says Mayor Brown.

“I am not proposing to sell the port. Under a lease operating model, the Council would continue to own the port, its land, and strategic assets. A lease gives us considerable control and choices. The operating partner would undertake the port’s commercial activities under strict conditions set by us. And the port’s commercial operations would return to the Council at the end of the lease term,” says Mayor Brown.

“The Council would enforce its lease conditions through financial penalties, a right to step in and fix any problems, and a right to terminate the lease early for any serious breaches.”

The Mayor is aware of concerns around privatisation and would consider a lease model for the port if:

-

We keep council’s waterfront land in public ownership in perpetuity.

-

We make better use of the port footprint and return port land for public use as soon as practical.

-

The port partner invests in rail, port road infrastructure, and has a plan to take trucks off our busy roads, particularly during the day.

-

The port ceases coal imports and other ‘dirty, dusty trades’ as soon as practical, where alternatives exist for these trades. We want a cleaner, greener port moving forward.

-

We set improved operating, safety, and environmental standards, including a reduction in Scope 1, 2 and 3 emissions, with transparent reporting to council of performance against these standards, and penalties for falling short of our requirements.

-

We ensure port jobs are safeguarded and workforce entitlements are protected for those working at the port, including union representation, ideally with requirements to ensure local employment and business procurement are prioritised by any operating partner.

-

The operating partner pays for all future investment at the port to create growth and jobs, including a mandate to deliver on minimum asset maintenance standards to ensure there is no asset stripping, and invests in infrastructure ahead of the demand curve where commercially feasible.

-

We have the right to be consulted on matters we consider important to council and the community.

-

Port prices and access are properly regulated.

“These are my minimum requirements, and I have asked council staff to explore how these requirements could be delivered while ensuring that Auckland Council receives value for money under any arrangement,” says Mayor Brown.

“I will not allow unconstrained commercial activity on our waterfront at the cost of local businesses, but Auckland ratepayers cannot continue to subsidise importers because the Port is not recovering its operating and capital costs.

“I am not looking at this solely through the lens of financial performance. My proposal to return part of the waterfront to Aucklanders provides an opportunity for us to reimagine the way that we engage with the Waitematā Harbour. In 35 years, the port operations will return to the council and Aucklanders will have the Auckland Future Fund for generations to come.”

Contestable advice on the two port options will be commissioned by councillors, who will also have oversight of the appointment of investment advisors.

The Budget Committee will vote on what items from the preliminary mayoral proposal go to public consultation in February 2024. The final 10-year Budget (Long-Term Plan) 2024-34 will be adopted in June 2024.

“I want to encourage councillors to enter into this process with an open-mind, and to for us to consult with the public on a range of different options. We will listen to what matters most to Aucklanders,” says Mayor Brown.