With consultation on the council’s contributions policy closing on 17 October, Aucklanders are being urged to have their say.

Many have submitted their opinions and ideas since the consultation opened on 7 October.

“We are urging people who we’ve not heard from to get online and complete a feedback form to let us know what you think. This policy impacts all ratepayers not just developers and is instrumental in determining how council funds our community infrastructure” – Finance and Performance Committee Chair Cr Desley Simpson.

Auckland Council Development Contributions Review

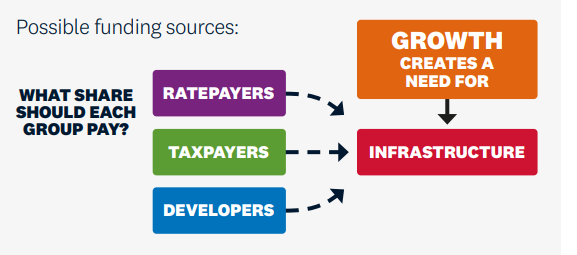

The council is conducting a review of its contributions policy. With exponential growth in Auckland, comes a lot of development. All of this requires infrastructure to support it.

Infrastructure is expensive and development contributions (DCs) are one of the ways the council recovers this cost. As growth investments also benefit existing properties, a fair share of the costs are funded by ratepayers and road users (via transport subsidies from Waka Kotahi funded by fuel taxes and road user charges).

Development contributions recover the share of costs caused by, or that will benefit from, development. If this share of the costs isn’t met by developers it will need to be funded by ratepayers or taxpayers.

We think it is fair that developers pay an appropriate share.

What we are proposing

Updating for new information in the Recovery Budget

We’ve made some exciting commitments in our 10-year Budget and we need to update our Development Contributions policy to recover a fair share of the cost of this planned investment. In this draft policy, the average development contribution will fall as the pace of growth is outpacing investment. However, in some areas it will rise, depending on the level of investment in that area.

Including projects beyond ten years

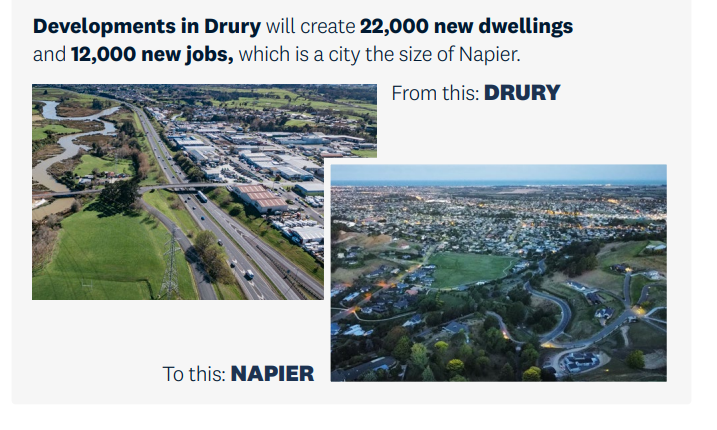

Additional infrastructure will be required to cope with the cumulative impact of growth in our priority areas over the next 30 years. All development in these areas will benefit from this investment so we propose updating the policy to include the longer-term infrastructure required to support this growth. For the Contributions Policy 2021, we are proposing to start with Drury. Drury is the area where we have the best information to implement the changes. Others will follow as work progresses.

We have included plans for $400 million of investment in local and arterial roads as well as parks and community facilities in the Drury area in the next ten years and a further $2.1 billion to be delivered beyond 2031. This totals an investment of $2.5 billion in the next 30 years. Under the new draft policy, development contributions will rise from between $11,000 to $18,300 currently, to $84,900. This ensures developers in Drury pay a fair share of costs. The alternative is for these costs to be met by ratepayers.

Development contributions and house prices

National and international evidence shows that increased contributions fees do not cause house prices to rise over time.

House prices are determined by the supply and demand for houses not the cost of land and buildings. Developers charge as much for housing as the market determines they can.

What increasing development contributions will do

Our research indicates that increasing development contribution charges will:

- better align these costs with the actual cost of infrastructure

- increase the certainty that infrastructure will be delivered

- ensure ratepayers don’t have to bear all the costs of growth.

Payment timing

We propose that payment of contributions required at building consent are payable at the grant of the consent. This is earlier than currently required and reverses the extension to payment timing we made for residential development in 2019.

COVID-19 significantly impacted the council’s finances. Requiring contributions to be paid earlier will mean the council can recover the cost of infrastructure sooner.

Development contributions and Māori land

We are proposing to:

- continue to support the development of marae and papakāinga and Māori housing on Māori land through

- make grants available through the Cultural Initiatives Fund

- exempt not-for-profit development on Māori land from reserve contributions

- retain the current payment timing for contributions payable at building consent for non-commercial development on Māori land, if changes are otherwise made to payment timing.